Art Basel and USB Group's annual Art Market Report has shown an encouraging return to normality in global art sales as well as revealing more on how NFTs will continue to shape the art market.

The art market has bounced back in sales, according to a new report by Art Basel and USB Global.

The annual Art Market Report has long been an invaluable tool in assessing the health of the global fine art market and the newly-released 2022 edition has been an optimistic one.

A year can make all the difference after a dour report from 2021, that saw the pandemic cause a significant drop in global art sales. Sales dropped by 22 per cent during the pandemic with art and antiquities estimated to reach $50.1 (€45.1) billion in 2020.

But this year’s report shows the figure bounced back up in 2021 by 29 per cent to reach $65.1 (€58.6) billion in global art sales. A figure that exceeds pre-pandemic levels.

“Despite finding ways to maintain trading online, the pandemic had a deep and profound effect on businesses in the art trade. The market showed great resilience under continuing uncertainty in 2021, with the recovery buoyed by robust growth, particularly in the auction sector, where secondary market sales of high-end works of art provided a significant uplift in value.”

Online and offline sales on the up

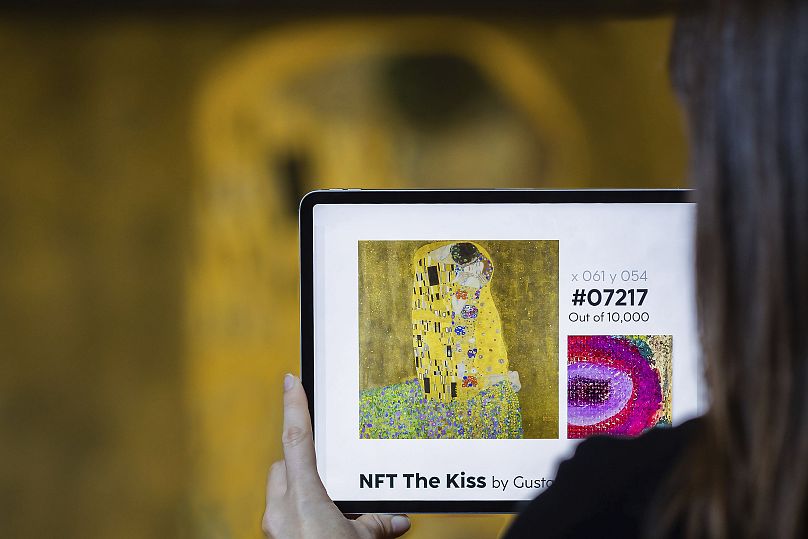

The big news story from the previous annual report was the increase in sales of online art and the growing NFT sector. At the release of the mid-year report, Euronews Culture looked into the impact NFTs would have on the art market, and what exactly distinguishes an NFT collectible and a piece of digital art.

While there has been an increase again in the online market for art (by seven per cent), the increase was at a much more leisurely pace than was seen during the more pandemic affected 2020.

During 2020, online sales doubled in value to reach $12.4 billion. This year, that number has made a more muted increase to $13.3 billion, taking up 20 per cent of the market, a reduced share than in 2020, but still considerably higher than the nine per cent figure from 2019.

The reason for the slight reduction in online market sales is partly due to the revitalisation of auction sales. Public auction sales were up 47 per cent from last year. As people are able to return to auctions physically, sales have shown the passion and verve for purchasing art has not gone anywhere.

Predictions also abound for this year, with 53 per cent of market participants claiming they’re expecting to spend at least as much as they had last year.

NFTs everywhere you look

While online sales saw a reduction in overall share of the market, the rise in NFTs discussed in last year’s report is an ever-increasing phenomenon.

Sales of NFTs aren’t considered as part of Art Basel and USB Group’s metrics for art market sales as they are external to the art market. Nonetheless, the report notes an increase in sales across the blockchain from $4.6 million to $11.1 billion.

Art-related NFTs also saw a huge rise in interest with a hundredfold increase year-on-year to reach $2.6 billion in sales.

The trade of art NFTs has been widely discussed as a potential means for removing the gatekeepers to the art market that exist in typical contemporary art. Without the need to work with traditional art dealer intermediaries, an art NFT can feasibly be traded openly on the blockchain.

But despite the increase in NFT sales, the reduction in gatekeepers to art sales has not been seen. “Much of the growth of online sales in the art market has been sales conducted directly via existing intermediaries, through dealers’ and auction houses’ own websites and platforms.”

NFTs are also yet to make a massive dint into the sales of the big art houses. Sotheby’s and Christie’s sold $230 million in NFTs in 2021, barely a scratch on their gross revenues of over $14 billion.

But increase is growing in NFTs, as the pool of interested buyers has swelled to over 130,000 on blockchain platforms, from a mere 1,370 buyers in 2019. The astronomical rise in NFTs is set to continue and remain a key interest in the development of the art market.