Three tech giants reported results after the market closed. Meta to pay dividend after jump in profits.

Thursday's quarterly earnings reports revealed a striking narrative as Meta Platforms, Amazon.com, and Apple not only surpassed Wall Street's forecasts but also delivered a resounding message of resilience for the US tech sector.

These three tech titans, with their over $5 trillion (€4.6 trillion) combined market valuation, have effectively countered the creeping doubts about tech growth triggered by the less-than-stellar performance of Alphabet and AMD earlier in the week.

Meta Platforms leaps forward with AI and the Metaverse

Meta Platforms announced a significant revenue boost to $40.1 billion (€37 billion) for the quarter ending December 31 - a 25% increase from the previous year and overtaking the estimates of $39.01 billion (€36 billion). The advertising revenue, a key performance indicator, reached $38.71 billion (€35.7 billion), outperforming expectations of $37.81 billion (€34.9 billion).

The net income for the quarter rocketed by 201% compared with the same period in 2022, amounting to $14.02 billion (€12.9 billion), with the earnings per share (EPS) reported at $5.33, eclipsing the forecasted $4.91.

"We've had a strong quarter, and our growth trajectory is a testament to our ongoing investment in AI and the metaverse," expressed Meta's CEO, Mark Zuckerberg.

Following this strong performance, Meta's board declared a $0.50 (€0.46) per share dividend—the company's first—and greenlighted a $50 billion (€46.1 billion) share buyback plan. Shares of Meta Platforms jumped by 14.3% in after-hours trading, with the company's market capitalisation breaching the $1 trillion mark.

Amazon delights with record sales and innovative AI Assistant

Amazon's fourth-quarter narrative was marked by a 14% surge in net sales to $170 billion (€156.9 billion), up from $149.2 billion (€137.6 billion) on the previous year's quarter, surpassing the $166 billion (€153.1 billion) market estimate.

The retail behemoth reported a rise in net income to $10.6 billion (€9.78 billion), with an EPS of $1.00, which exceeded analysts' predictions of $0.79.

"It's been a banner quarter and a testament to our team's hard work, marking a record holiday season and capping off a strong year for Amazon," Andy Jassy, Amazon's CEO, stated.

Amazon also announced the launch of Rufus, a cutting-edge generative AI-powered shopping assistant, aiming to enhance the customer shopping experience. After these announcements, Amazon's shares increased by 6.1% in after-hours trading.

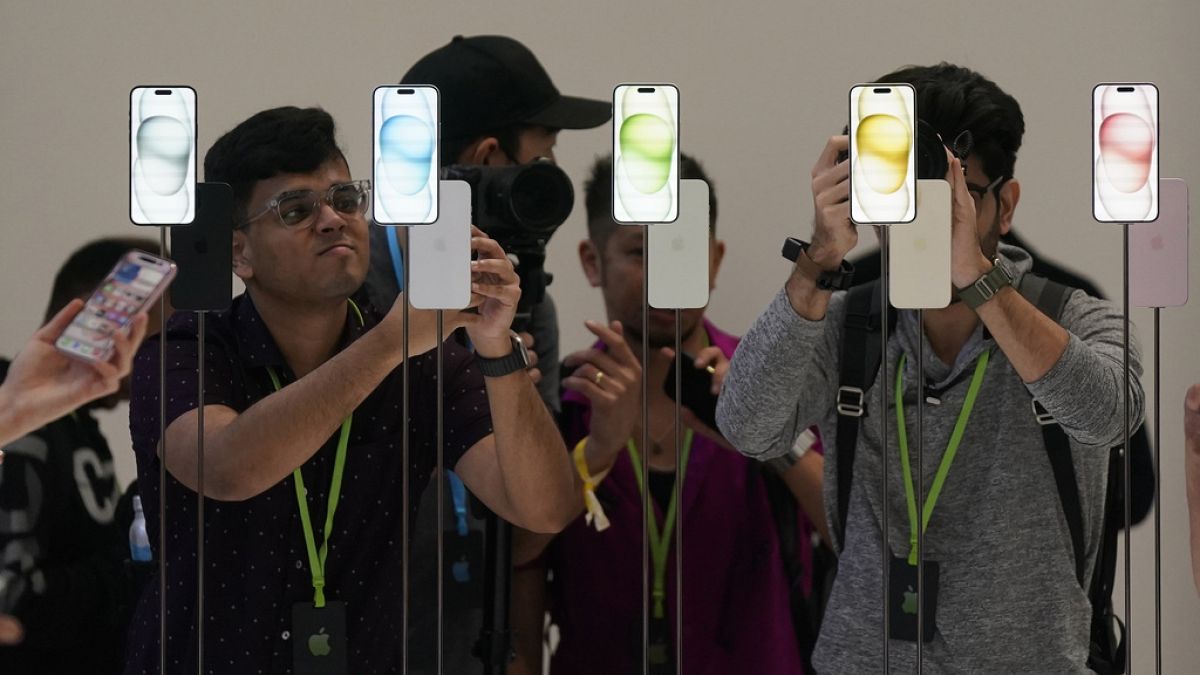

Apple's performance mixed with robust iPhone sales but Chinese setback

Apple's revenue edged up 2% to $119.58 billion (€110.3 billion), exceeding expectations of $117.97 billion (€108.8 billion). This marked a turnaround in revenue growth following four consecutive quarters of decline. iPhone revenues hit $69.7 billion (€64.3 billion), outstripping forecasts of $68.55 billion (€63.2 billion). However, revenues for iPad and Mac underperformed, bringing in $7.02 billion (€6.48 billion) and $7.78 billion (€7.18 billion), respectively, against higher expectations.

A slight increase in the sale of more expensive iPhones nudged Apple's gross margin up from 45.5% to 45.9%, with EPS lifting to $2.18 (€2), up 16% from the previous year and over the predicted $2.09 (€1.92).

"Apple's December quarter saw revenue growth driven by strong iPhone sales and a record performance in services," declared Tim Cook, Apple's CEO.

Despite the positive earnings, Apple's performance in China was notably lacklustre, with sales at $20.82 billion (€19.21 billion), missing the $23.5 billion (€21.67 billion) mark expected by analysts and reflecting a downturn from the previous year.

"We are not happy with the decline but we know China is the most competitive market in the world. We continue to see significant opportunity there," Luca Maestri Apple CFO, said.

Apple's shares fell by 3.2% in after-market trading as the market acknowledged the challenges in China.