The story of liquified natural gas (LNG) — natural gas cooled down to liquid form for ease and safety of non-pressurised storage or transport — is getting interesting as it increases its share in the global primary energy mix, Osama Rizvi writes.

In the highly charged geopolitical environment of today, liquified natural gas (LNG) markets are expected to stay volatile.

However, even if the geopolitical tensions were to ease, the outlook for LNG remains bearish as can be seen by the fact that gas prices have started to fall in Europe.

With an unprecedented investment in LNG, consumers can breathe a sigh of relief as prices may remain subdued due to the increasing supply.

According to Neil Beveridge, managing director at Sanford C Bernstein & Co, about 140 million metric tonnes (amounting to 30% of the present global LNG market) will be added to the supply over the next three years. Many projects in North America and Qatar are also expected to come online.

Additionally, according to Bloomberg NEF, more than 300 million tonnes of new LNG capacity will be added by 2030 — a whopping 70% surge from today.

"This begins the third big wave in LNG," said Anne-Sophie Corbeau, a global research scholar at the Center on Global Energy Policy at Columbia University's School of International and Public Affairs. Morgan Stanley sees an oversupplied market with the surplus standing at 4 million metric tonnes.

In terms of LNG demand, Asia is expected to lead the way. This isn't surprising especially when we consider the fact that Asia is forecast to contribute more than 40% to global growth in 2024.

As far as Europe is concerned, so far there seem to be no imbalances.

European economic outlook is still replete with headwinds in the form of higher-for-longer interest rates, sticky inflation and political issues. The weather can change the scenario, however, and, for most of this winter, it has remained subdued.

The industrial slowdown in the eurozone will continue to put downward pressure on the demand side and robust levels of stockpiles will help in case of an unexpected spike in usage.

This means that consumers might be looking at a mixture of conflicting signals as economic indicators continue to go downside. However, they may get some breaks in terms of energy prices. Any further escalation in geopolitical tensions could, of course, result in a spike in oil and gas prices.

Price expectation

According to the Gas 2023 Medium Term Market Report, the gas demand across the world will grow on average by around 1.6% between 2022 to 2026 per year. This is down from the previous five-year average of 2.5% a year between 2017- 2021.

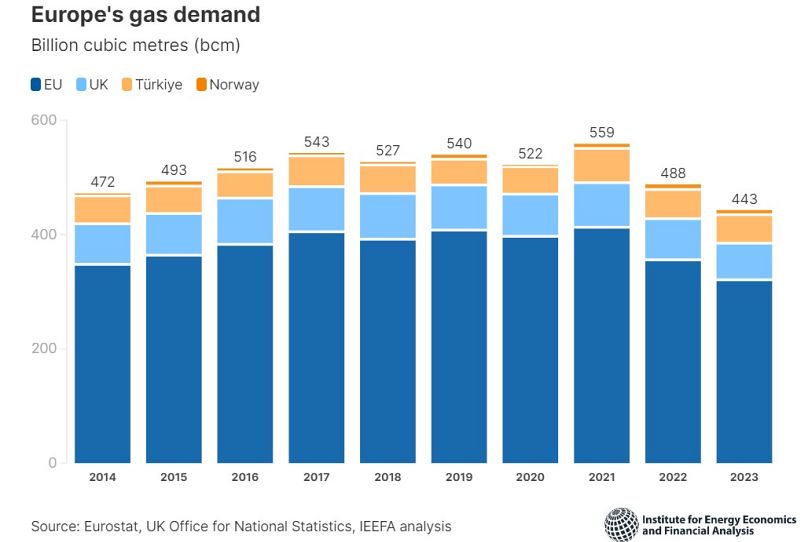

According to various estimates, gas demand in Asia, North America and Europe peaked around 2021 and is forecasted to reduce by 1% per year until 2026.

In the case of Europe, this decline can also be attributed to the fact that after joining the REPowerEU Plan, the deployment of renewable sources has increased considerably.

Therefore, in terms of price estimates, we might not see a bullish market. Apart from the structural trends mentioned above, the global economic backdrop is not very conducive to a bullish LNG market scenario.

According to Morgan Stanley, the price outlook for 2024 has already been reduced to €10.10/MM British Thermal Unit, down from €12.85/MMBtu. In terms of spot prices, the bank estimates it to average between €10.37 and €12.94/MMBtu.

The global energy market in general and gas markets in particular have changed fundamentally because of the war between Russia and Ukraine.

It has led Europe — due to its dependence on gas from Russia — to diversify both in terms of suppliers and energy mix.

However, until or unless the open geopolitical fronts resolve or de-escalate, a sudden spike in LNG prices can always be expected.

The bottom line is that it is in Europe's interest to keep its inventories high and refill them as per schedule, which thankfully is happening.

Osama Rizvi is an economic and energy analyst with a focus on commodities, macroeconomy, geopolitics, and climate change.

At Euronews, we believe all views matter. Contact us at view@euronews.com to send pitches or submissions and be part of the conversation.