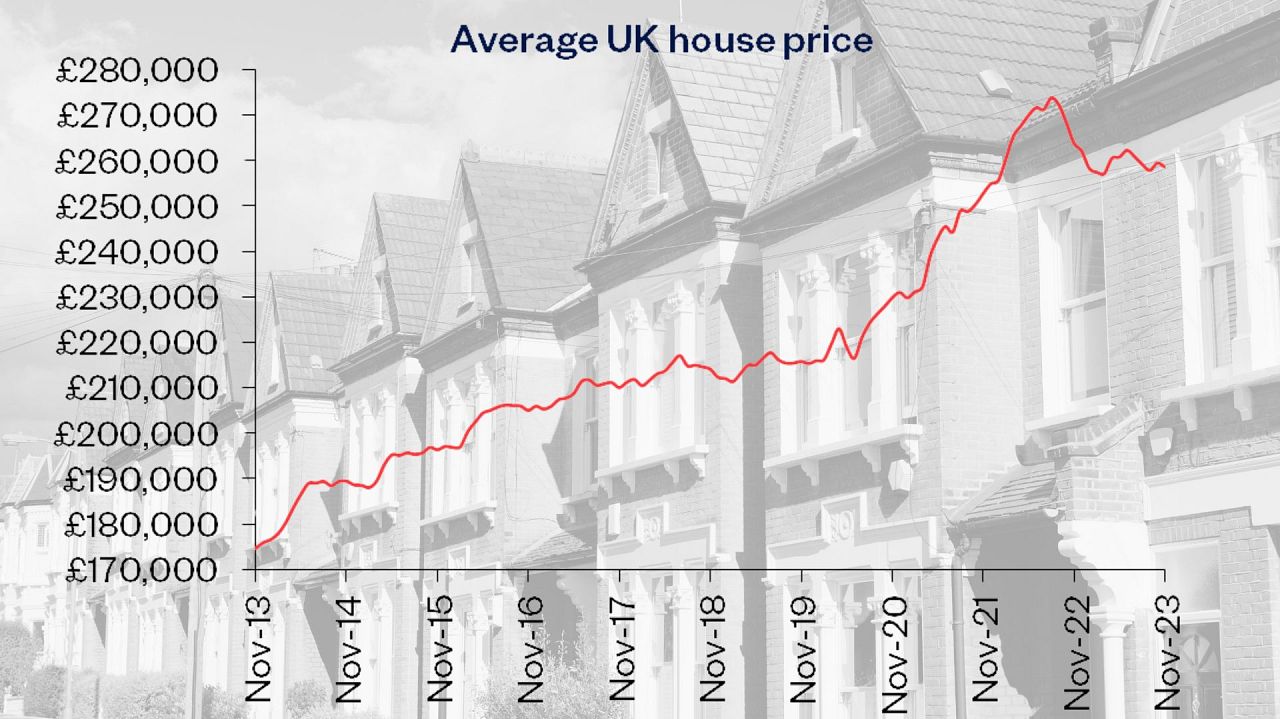

House prices rose in November compared to October but are still cheaper than this time last year, according to a new report.

UK house prices rose by 0.2% month-over-month in November 2023, defying negative forecasts but also slowing from a 0.9% gain in October, according to the latest figures of mortgage lender Nationwide Building Society.

The Nationwide House Price Index was down 2% in a yearly comparison, though, it is still triggering hopes of a revival of the recently staggering real estate market in the UK, as it shows a sizeable slowdown from the annual drop of 3.3% in the previous month.

The average cost of a home was £258,557 (€300,492) in November.

As the latest monthly figure marks a rise for a third month in a row, there are rising expectations that the UK housing market is about to open a new chapter.

Britain's housing market has been hit by high borrowing costs as the Bank of England pushed key rates to a record level of 5.25% in order to battle inflation. Recent data about consumer prices triggered a shift in what the market expects from the central bank.

“There has been a significant change in market expectations for the future path of Bank Rate in recent months which, if sustained, could provide much needed support for housing market activity," Robert Gardner, chief economist at Nationwide, said in his report.

The cautiously increasing prices could reflect a rising confidence that market conditions are easing in the following months, as interest rate expectations decline.

A decrease in the longer-term interest rates that underpin fixed rate mortgage pricing, paired with solid income growth and weak or negative house price growth, "should help underpin a modest rise in activity in the quarters ahead," Gardner also noted.

“Nevertheless, a rapid rebound still appears unlikely," adds the report, as consumer confidence is still weak and there are looming risks that inflation might take an upturn and the Bank of England has to step up again.