London is the only place in the UK where tenant demand has shrunk over the last three months ending in October, a survey shows.

The rental market in the UK is grappling with high demand from tenants, except in the capital, where an increasing number of people cannot afford to pay rent anymore, the latest Royal Institution of Chartered Surveyors (RICS) UK Residential Survey showed.

The report, serving as one of the most reliable indicators projecting what lies ahead for the British housing market, surveys market participants, mainly real-estate agents.

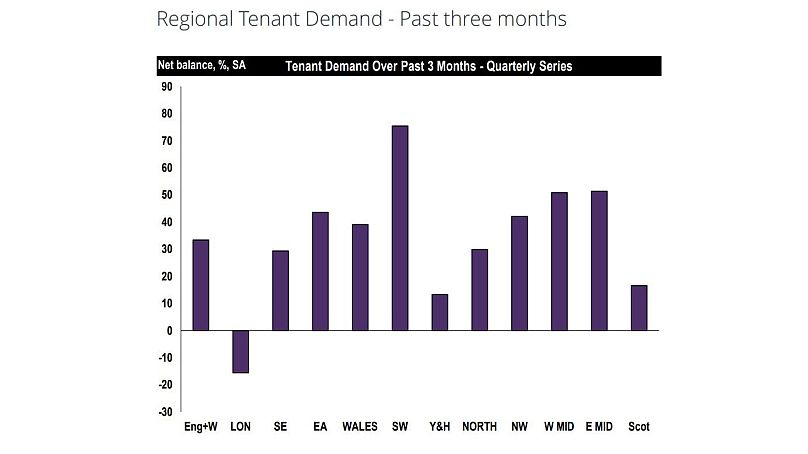

According to RICS findings, there has been an overall increase in tenant demand nationwide in the three months leading up to October. However, the rise is the most modest quarter-on-quarter in the last two years.

London is the only region with decreasing demand according to the survey.

The affordability of rent in London could well hold the answer as to why demand is lagging behind.

“For the first time for several months we have noticed affordability issues mean tenants are refusing to pay record rents,” said Jeremy Leaf, an estate agent in Finchley, north London. “We certainly expect a correction particularly as instructions (new rental properties, ed.) remain low and aspiring first-time buyers are reviewing rental agreements due to mortgage repayment concerns.”

Another report is sounding the alarm over the situation; London Councils, a cross-party organisation representing London's borough councils, commissioned a report which claims that by 2030 some 60,000 people could become homeless in the city, due to the unaffordable prices.

One of the largest property portals, Zoopla, said in its September report about the UK rental market that rents continue to outpace earnings and rental affordability is now the worst for over a decade. They, however, haven’t experienced lowering demand.

Yet, the company sees strong demand in the capital. “The rental market in London is still stuck in a seemingly endless cycle of low supply and strong demand which has consistently kept rental growth in double digits,” Richard Donnell, Executive Director at Zoopla said to Euronews Business. “Rents in London currently stand at £2,057 per month - almost £1,000 higher than the UK average of £1,166."

Landlords are fleeing the market

Meanwhile, the rental market is struggling with a decreasing amount of properties as landlords are leaving the market due to the tightening rules and high mortgage rates squeezing their profit.

“Having seen record rents being achieved earlier this year, applicant numbers have fallen while landlords take on board a market that is showing signs of slowing,” Said real-estate agent John King from Wimbledon in the RICS report.

“Stock continues to fall away from lettings towards sales as more and more landlords choose a sale over re-letting,” said another of the survey participants, Jilly Bland from Robert Holmes & Co.

Property tax consultancy Cornerstone Tax found in its latest report that a record number of landlords, 15%, are considering selling their property due to the rising costs, citing data that shows UK landlords are collectively paying £15 billion in mortgage interest annually, 40% more than a year ago.

Rental prices are expected to increase further

Average rental prices have been traditionally eye-watering in the British capital - and they have further increased by approximately 10% on average in the last 12 months, according to participants in the survey.

And there is more inflation on the horizon as the increase in demand paired with decreasing choices of homes puts an upward pressure on the prices.

“As supply continues to fall, upwards pressure on rent levels can be seen across London,” said Christopher Baker, an associate from Mcdowalls Surveyors Limited in London. “There is a worry that existing tenants will eventually simply not be able to afford the rents being asked, leading to larger arrears.”

Yet, for the next 12 months, the RICS survey forecasts an approximate 4% increase in the rental prices across the country.

“We are seeing signs of demand slowing and rents may well begin to peak, but we still desperately need more rental property to stem demand and stabilise rents,” Allan Henry Fuller, an estate agent in Putney in west London, said in the survey.

The high borrowing costs in the UK are tied to the Bank of England’s key interest rate which is not in a hurry to lower the current 5.25%. This hit the housing market which grapples with lowering demand and decreasing prices.

The RICS survey suggests no major change in the sales market for the remainder of this year but property professionals expect sales to stabilise in the next 12 months.

Meanwhile, as sales struggle to rebound, the demand in the overall UK rental market is expected to keep swelling.

As for the future in London, “financial pressures, uncertain regulatory reform and the alignment between tenants’ and landlords’ expectations will be key over the coming months,” Marcus Goodwille from Savills Plc. said to RICS.