Finance ministers from France, Germany, Italy and Spain say the time has come to reach a deal on an "international tax system fit for the 21st century".

The EU's four largest economies -- France, Germany, Italy and Spain -- have stepped up the pressure for agreement to be reached to stamp out tax abuse by multinationals, as G7 meetings take place on Friday.

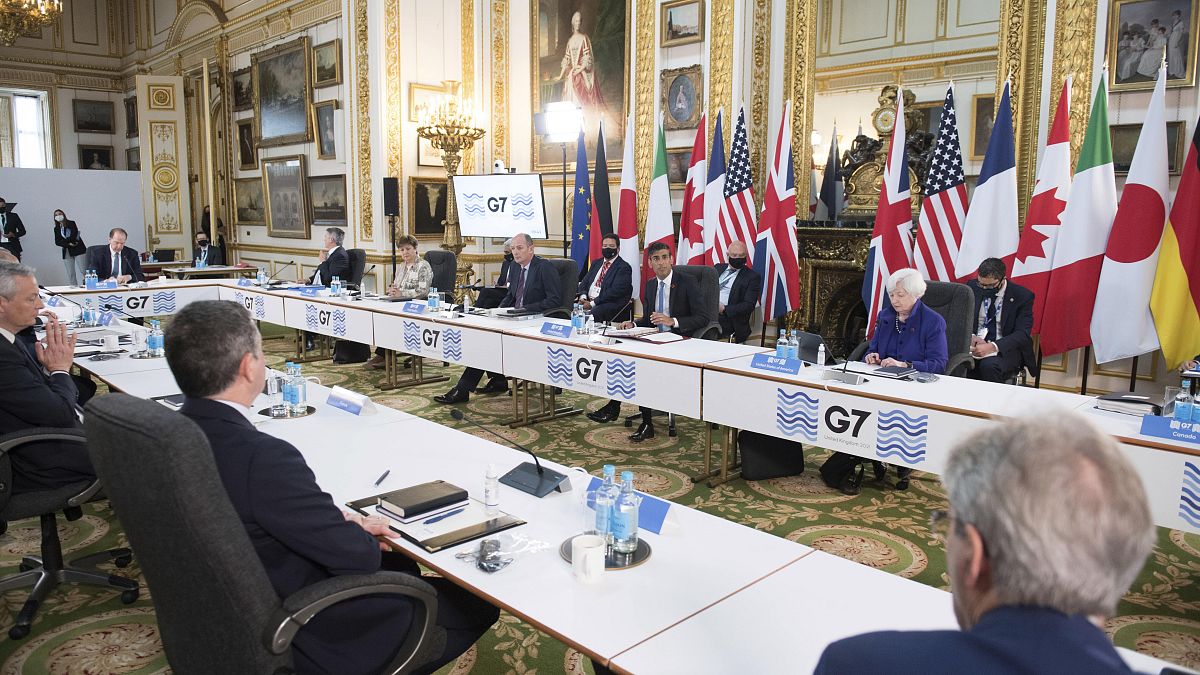

Finance ministers from the intergovernmental organisation are meeting in London ahead of a full summit in England in a week's time.

Ministers from the four European heavyweights say the time has come to reach a deal on an "international tax system fit for the 21st century", following their countries' four-year effort.

"It is a saga of many twists and turns. Now it’s time to come to an agreement," Bruno Le Maire, Olaf Scholz, Daniele Franco and Nadia Calviño say in a joint letter to the Guardian. "Introducing this fairer and more efficient international tax system was already a priority before the current economic crisis, and it will be all the more necessary coming out of it."

Spain is not a member of the G7 but its minister signed the letter in a show of unity.

The four add that the crisis brought by the pandemic has been a "boon to big tech companies", and has "exacerbated inequalities". An international consensus is needed, building on the work of the Organisation for Economic Co-operation and Development.

They cite a window of opportunity provided by US President Joe Biden's proposal for a minimum global corporation tax rate.

"With the new Biden administration, there is no longer the threat of a veto hanging over this new system," the French, German, Italian and Spanish ministers write, referring to the hostile stance taken by Donald Trump. "The new US proposal on minimal taxation is an important step in the direction of the proposal initially floated by our countries and taken over by the OECD."

Joe Biden initially backed a 21% rate before revising the figure down to 15% in a bid to gather more support. Within the EU, the proposal is opposed by some countries including Ireland and Hungary, which have particularly low rates.

The International Monetary Fund (IMF) has said it is "very much in favour of a global minimum corporate tax".

The ministers conclude their letter by saying a G7 deal could pave the way for a global agreement at the G20 summit in Venice in July, which would bring on board countries such as Brazil, China and India.

Friday's meeting is the first time that finance ministers from the United States, Japan, Germany, the UK, France, Italy and Canada have met face-to-face since the start of the coronavirus pandemic.

“I’m determined we work together and unite to tackle the world’s most pressing economic challenges -- and I’m hugely optimistic that we will deliver some concrete outcomes this weekend,” UK Chancellor of the Exchequer (finance minister) Rishi Sunak said in a statement late on Thursday.

Earlier this year EU member states agreed on new transparency rules for multinational companies reporting tax payments across the bloc, aimed at forcing some of the world's largest firms to be more open.