How worried should Europe be if the Italian crisis is portrayed by Eurosceptics as financial markets defying the will of Italian voters?

Europe’s establishment is spooked by the strong possibility that an early election in Italy will become a referendum on Italy’s membership of the euro, and even on its place in the European Union.

The bloc’s orthodox economics could well be set on a collision course with a big political question likely to rouse Eurosceptic passions still further:

Who rules Italy?

Do Italians govern their own affairs? Or are they at the mercy of a Brussels-dominated, EU elite?

European officials scrambled on Tuesday to put out fires lit by the Budget Commissioner, Guenther Oettinger, who appeared to suggest the markets would dictate to Italians how to vote.

“My worry, my expectation, is that the coming weeks will show that the markets, government bonds, Italy’s economy, could be so badly hit that these could send a signal to voters not to elect populists from the left or right,” he told Deutsche Welle. “I can only hope that this plays a role in the election campaign by being a signal not to hand governing responsibilities to the populists.”

The EU’s top brass rushed to reassure Italy that it would respect the right of its voters to make their own choice.

“Italy’s fate does not lie in the hands of the financial markets,” said Commission President Jean-Claude Juncker. “Please respect the voters. We are there to serve them, not to lecture them,” added Donald Tusk, who chairs EU leaders’ summits. “Italy’s destiny must be decided in Italy, not Brussels,” said Economic Affairs Commissioner Pierre Moscovici.

Oettinger apologised, but his comments are likely to fuel anti-German, anti-Brussels reaction in Italy. The anti-establishment Five Star Movement called on him to resign.

How have markets responded?

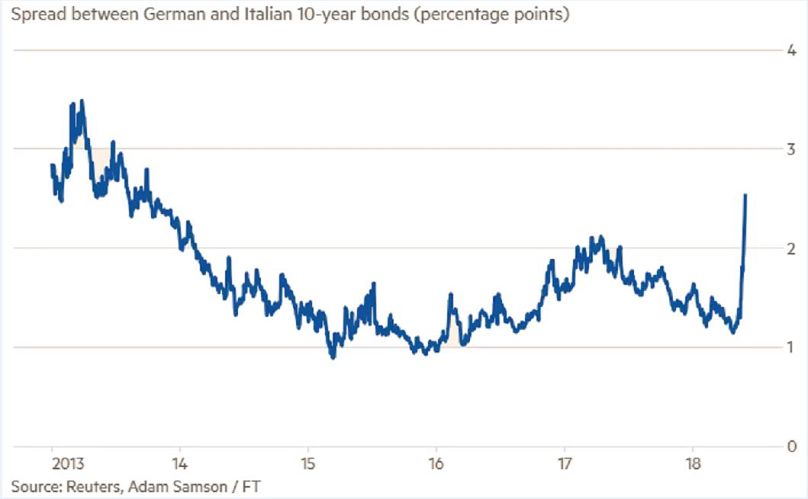

The latest events have pushed markets – already nervous since the inconclusive Italian elections in March – into a global stock selloff. This week has seen the euro fall to an 11-month low and sent Italy’s short-term borrowing costs to their highest for five years.

Moody’s ratings agency has put the country’s credit rating “on review” for a possible downgrade.

On Wednesday Italian stocks staged a modest recovery and government bond yields settled below the highs prompted by Tuesday’s turmoil. Foreign exchanges were quieter and the euro rallied slightly.

However, for the European establishment the spectre of an outright Eurosceptic election victory in Italy is very real. The fear then is that the financial situation could spiral out of control, should a new government seek to blow EU rules on debts and deficits out of the water.

How great is the danger?

So far there has been some evidence of other European markets being affected, but the financial situation is not seen as being as drastic as it was at the peak of the Eurozone crisis in 2012.

There has been some concern that Italy may become “the new Greece”. In 2015 Athens nearly fell out of the euro after its left-wing government rejected austerity terms demanded in return for Eurozone government loans.

Italy’s economy is ten times that of Greece and has been deemed “too big to fail”, simply impossible to bail out. But although it is sluggish the Italian economy is seen as being far stronger.

Many fears have been expressed over the motley coalition that was effectively blocked by President Mattarella. He was exercising his constitutional powers, but the prospect of a further anti-establishment backlash has caused panic.

However, an important factor is that although the two parties in question have been strongly critical of the euro, the joint draft programme put forward by Five Star and the far-right League does not seek to ditch the single currency.

Opinion polls have suggested a clear majority of Italians, around 60 percent or more, are in favour of keeping it.

Some analysts say a clear commitment by the Eurosceptic parties to keep Italy in the euro could go a long way to soothe market turbulence, although fears would remain over the impact of their fiscal policies.

What is the response of Italy’s political parties?

Italy’s interim Prime Minister Carlo Cottarelli has so far failed to find support from any major party for a temporary administration. He met President Mattarella on Wednesday morning for brief informal talks.

Reports on Wednesday said Five Star and the League had renewed efforts to form a coalition government, seeking to find a compromise candidate for economy minister after the president rejected their previous Eurosceptic choice.

But the situation remains fluid and unpredictable, with the possibility of fresh elections as early as July. The leader of the League, Matteo Salvini, has said “the earlier we vote the better”.

A new opinion poll by IPSOS shows a surge of support for the League, from 17 percent in the March elections to a quarter of the vote now. It has argued that fiscal rules governing the Eurozone are “enslaving” Italians.

With backing for its partner Five Star stable at over 32 percent, both parties combined could win a clear majority and the would-be coalition would become a reality.

In such a scenario, the victorious Eurosceptics would be unlikely to toe the EU line. They would argue they had a mandate to ramp up spending in the heavily indebted nation, and call for a revision of Europe’s fiscal rules.

In the meantime, there is likely to be intense pressure on Italy from Brussels, Berlin, Paris and beyond – albeit expressed as sensitively as possible – not to rock the Eurozone boat.