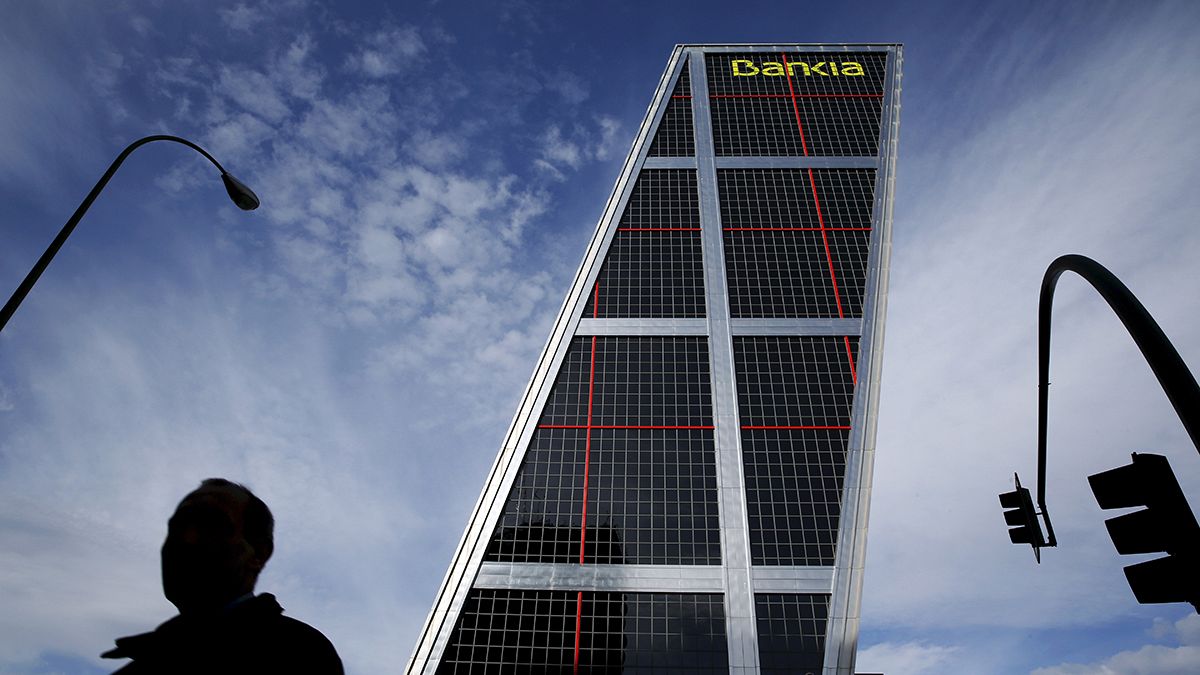

Spanish banks' problem loans fell in May - the 18th straight month that they have dropped.

There was good news for Spanish banks with another fall in the number of bad debts they have on their books.

It was the 18th straight month that they have dropped following a state-backed clean-up of the banking sector.

The number of loans that have not been repaid for more than three months, or that are in danger of falling into default, is now 9.8 percent of the total credit in Spain’s banking system. That is down from 9.9 percent in May and 11.4 percent a year ago, according to the Bank of Spain.

Spanish lenders have mostly recovered after taking big writedowns on their property holdings in 2012. But many are still in the process of clearing their books of non-performing property loans because sales of those loans to distressed debt investors has been a slow process.

After the 2008 property crash and recession the government moved to bail out several banks with European cash. It also created a so-called bad bank three years ago to take on their most toxic assets.

In more good news for Spain’s banks, on Tuesday the European Court of Justice’s advocate general backed a Spanish court’s ruling for a cap on banks’ liabilities in some mortgage contracts. A ruling the other way could have cost them millions in compensation.

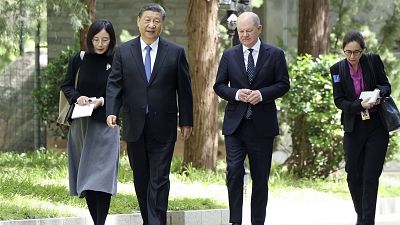

And now Italy

The European Central Bank has made tackling bad debts one of its major targets for 2016 and the focus is now on Italy, which did not follow Spain’s example in dealing with its banks’ problem loans quickly.

Italian bank shares have dropped sharply this year partly because of uncertainty about how they will deal with a 360 billion euro pile of problem debts, equivalent to around 18 percent of total lending.

Italy has created a bailout fund, Atlante, to stabilise the system. Backed mostly by private Italian financial institutions, it has been in talks to help the country’s third-largest lender Monte dei Paschi di Siena cut its bad loans.

World’s Newest Banking Crisis Centers on World’s Oldest Bank: #Italy’s Monte dei Paschi https://t.co/SRin3Ofzs5

— Pedro da Costa (@pdacosta) July 14, 2016